Since Binance listed USD1, the stablecoin’s transaction volume has increased tenfold. BNB Chain is also supporting USD1, onboarding new on-chain partners to promote ecosystem utility.

World Liberty Financial (WLFI) is also taking steps to bring USD1 closer to meme coin traders. Still, there are lingering concerns about the stablecoin’s extreme level of token centralization.

SponsoredUSD1 Transactions Spike Thanks to Binance

President Trump is engaged in several crypto ventures, and the USD1 stablecoin has been attracting a lot of interest lately. The Binance listing in late May immediately boosted trade volume, but the full significance didn’t immediately materialize.

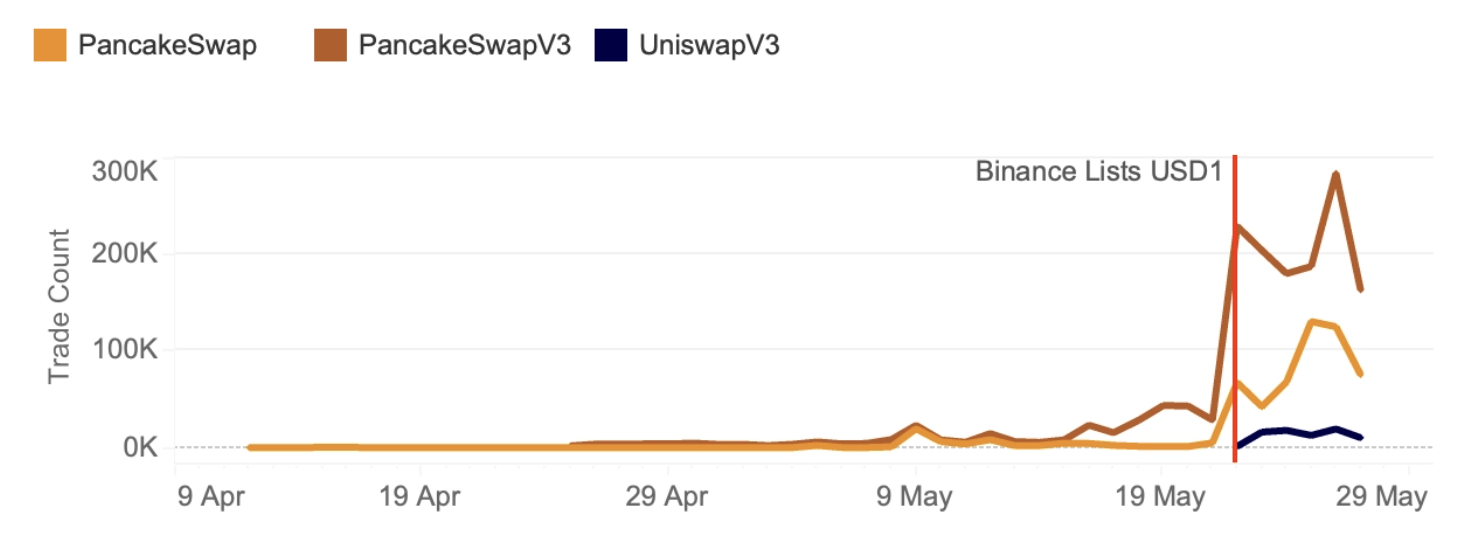

However, a new report from Kaiko shows just how far USD1 transaction levels have increased in recent weeks:

Clearly, despite a few controversies, World Liberty Financial’s stablecoin is doing quite well. Since the Binance listing, WLFI introduced USD1 restaking, and that’s not the only measure to enhance activity.

BNB Chain has been taking several measures to boost USD1’s transaction volumes, and it described a few of them today.

This active support from BNB Chain shows Binance’s sustained interest in USD1. By onboarding diverse on-chain partners like wallets, CEXs, and on-chain apps, the firm is helping World Liberty pursue its ambition of creating an important payment stablecoin.

This may signal increased affinity between the two firms in the future.

WLFI, of course, has also been launching initiatives of its own. The firm recently promoted meme coin trading with USD1 on PancakeSwap, further incentivizing users to keep this transaction activity elevated.

SponsoredBy integrating USD1 with the meme coin sector, it’ll increase traders’ exposure to this growing stablecoin project.

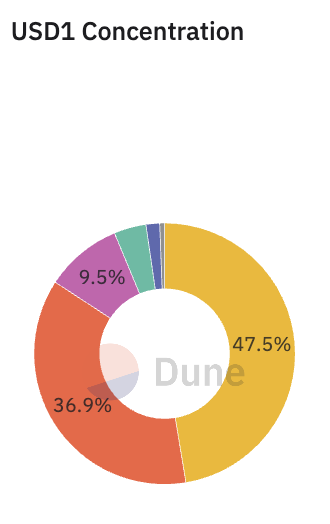

Currently, WLFI has more than enough supply to support these transactions; USD1’s market cap is over $2 billion. Still, the firm has attracted some criticism about its tokenomics.

Specifically, it is extremely centralized. More than 93% of USD1’s market cap is held by three wallets, a truly staggering level of concentration.

Still, all things considered, things are looking reasonably bullish. WLFI has already teased major airdrops, which would give the firm an opportunity to reduce this centralization.

If USD1 transaction volumes keep climbing at this rate, it could become a major player in the broader stablecoin ecosystem.