November 5, 2020 – CoinGecko, the world’s leading independent cryptocurrency aggregator, has just released its October Report. In their analysis of the market, CoinGecko found that Bitcoin had quite a bullish month due to a number of factors.

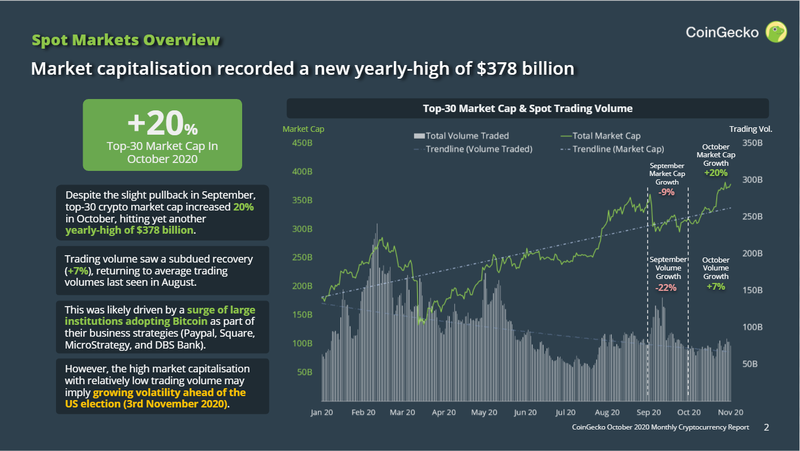

Bitcoin began its rally as soon as the ETH craze caused by the DeFi boom began to cool down. Additionally, the month of October saw a lot of institutions such as PayPal, Square, and DBS Bank taking steps in adopting the cryptocurrency. The news of its adoption certainly helped to drive the positive sentiment for Bitcoin.

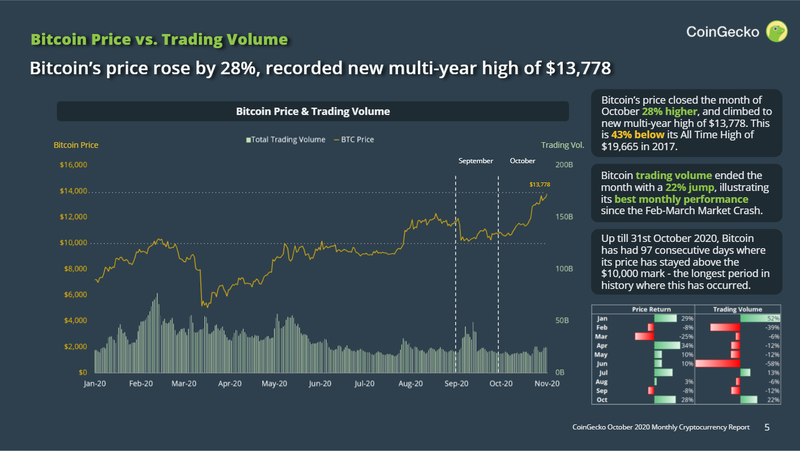

SponsoredAs a result, Bitcoin’s price at the end of October was 28% higher and hit multi-year highs at $13,778. Further proof of Bitcoin’s growth can be found in its trading volume which ended the month with a 22% increase. In fact, this is its best monthly performance since the February-March market crash.

Up till 31st October 2020, Bitcoin has had 97 consecutive days where its price has stayed above the $10,000 mark – the longest period in its history.

Other Highlights

- Total crypto market capitalization recorded another yearly-high of $378B

Despite a slight pullback in September, total cryptocurrencies market capitalisation still continues its ascent with an increase of 19%, leading to another yearly-high of $378 billion. Trading volume saw a slight recovery of 7% too, allowing it to return to average volumes last seen in August. This is likely due to a surge of large institutions adopting Bitcoin and implementing it into their business strategies. - Open Interest on Bitcoin Perpetual Swaps up 40% since early September, indicative of bullish sentiment on Bitcoin.

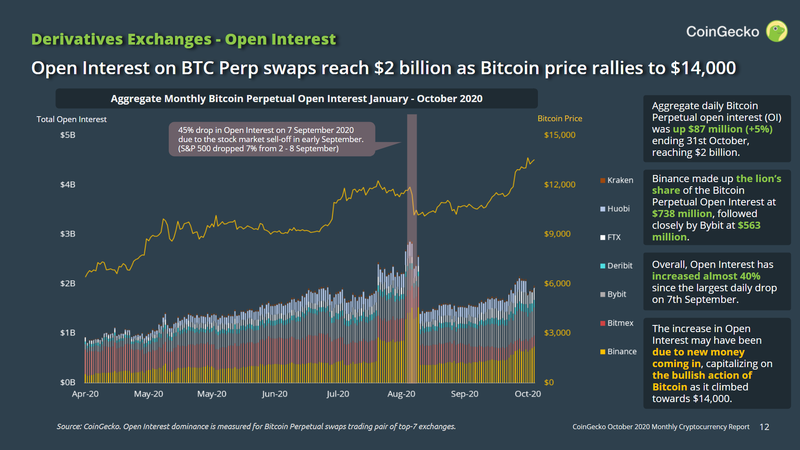

The aggregate Open Interest for Bitcoin Perpetual Swaps saw an increase of $87 million (+5%) this month, helping it reach a total of $2 billion. CoinGecko found that Binance made up the lion’s share of the Bitcoin Perpetual Swaps Open Interest at $738 million and Bybit followed behind at $563 million. Altogether, Open Interest on Bitcoin Perpetual Swaps increased almost 40% since its largest daily drop on the 7th of September. This increase was most likely caused by new money coming in to capitalize on Bitcoin’s bullish run. - Uniswap continues to dominate the DEX market, taking 69% of the market share.

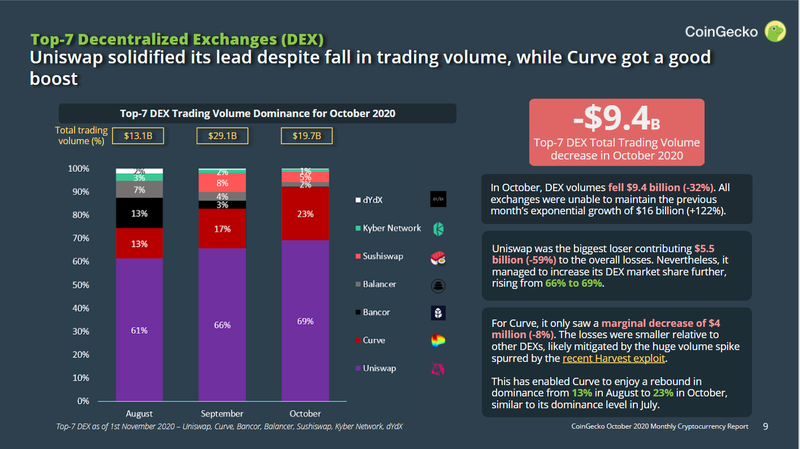

Lastly, CoinGecko found that DEX volume in October fell by $9.4 billion (-32%). This fall happened across all decentralized exchanges with Uniswap suffering the biggest loss of $5.5 billion (-59%). Despite the drop in volume, Uniswap still continued to maintain its position as the most popular DEX. In fact, the protocol solidified its market dominance increasing its market share from 66% to 69% in October.

Key Takeaways

- Bitcoin’s price rose by 28%, recorded new multi-year high of $13,778.

- Total crypto market capitalization recorded another yearly-high of $378B.

- Open Interest on Bitcoin Perpetual Swaps up 40% since early September, indicative of bullish sentiment on Bitcoin.

- Uniswap continues to dominate the DEX market, taking 69% of the market share.

About CoinGecko

CoinGecko is the world’s leading independent cryptocurrency aggregator. Since 2014, it has been the trusted source of information for millions of cryptocurrency investors. Its mission is to empower the cryptocurrency community with a 360-degree overview of the market. CoinGecko provides comprehensive information derived from thousands of data points such as price, trading volume, market capitalization, developer strength, community statistics, and more. It currently tracks more than 7,000 tokens from more than 400 exchanges.

Visit CoinGecko for more information.