Retail investors are watching from the sidelines or exiting altogether despite Bitcoin (BTC) attaining a new all-time high, and holding above $111,000 after a seven-week consolidation.

While institutional flows and whale accumulation have driven prices upward, several small traders have been liquidated during the rally.

Market Rallies Amid Retail Investor Doubt

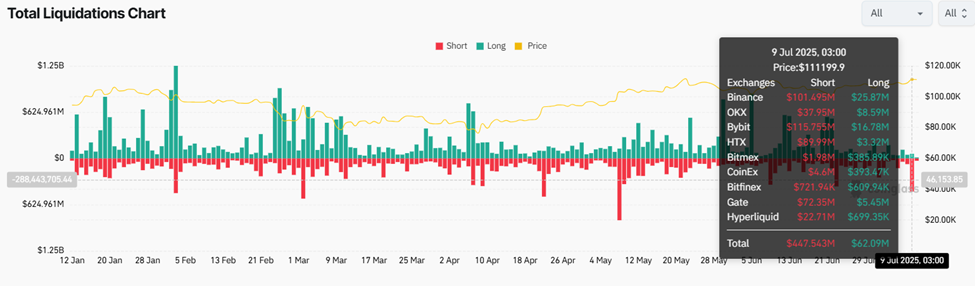

SponsoredAccording to Coinglass data, over 114,500 traders were liquidated in the past 24 hours, amounting to $515.34 million in losses.

The largest single liquidation order occurred on HTX, with a BTC-USDT position worth $51.56 million wiped out.

These forced liquidations, mostly from over-leveraged long and short positions, reveal how volatile the market remains even during price breakouts.

Sponsored SponsoredIn parallel, however, Santiment highlighted a deeper trend, signaling a retail capitulation. According to the on-chain analytics firm, Bitcoin wallets holding small amounts of BTC have been selling to whales. This behavioral pattern has historically preceded sharp rallies.

“Bitcoin price has consistently seen more bullish price action when the number of small wallets drops and whales accumulate,” Santiment’s on-chain analyst Brian indicated.

The data aligns with broader market psychology. Many retail investors had exited during the previous weeks, citing boredom, disbelief, or fear of a fakeout.

Ironically, that capitulation may have marked the moment smart money stepped in. The market now appears to be rising in what analysts call a “disbelief rally,” a phase where gains continue despite widespread skepticism.

“…many retailers had been dropping out due to boredom or disbelief over the past few days. History has shown that this is a prime sign of a potential breakout, as crypto markets typically move the opposite direction of the crowd’s expectations,” Brian added.

Veteran trader and analyst Michael Van de Poppe echoed the sentiment in a recent post, highlighting that most traders tend to be bearish at the start of a bull market.

Sponsored“At the start of the bull, 99% of the people will remain bearish. The coming month, you’ll continue to hear that the upwards run is fake on altcoins. That’s this part of the cycle,” the analyst remarked.

Despite Bitcoin’s fresh ATH and strong ETF inflows, the mood on crypto forums and social media remains cautious.

In the same way, the Crypto Fear & Greed Index is beginning to tilt back toward greed, but it has not yet reached euphoric levels.

Analysts suggest that as FOMO kicks in, holders will rise again, especially if altcoins begin catching up to Bitcoin’s performance.

For now, the disconnect between rising prices and retail skepticism may be setting the stage for the next leg of the bull market. If history is any guide, retail’s disbelief might be the ultimate fuel for Bitcoin’s continued climb.