On August 12, Marathon Digital Holdings announced a $250 million fundraising effort by issuing convertible senior notes.

The company plans to use the proceeds to expand its Bitcoin holdings, signaling its continued commitment to cryptocurrency investment.

Stock Market Response Lukewarm as Marathon Digital Unveils Bold Bitcoin Strategy

In its official statement, the Nevada-based Bitcoin mining firm revealed it will issue notes as unsecured senior obligations. These notes will bear interest and be payable semi-annually starting on March 1, 2025, and are due in 2031.

SponsoredThe offering targets qualified institutional buyers and includes an option for them to acquire an additional $37.5 million in notes. Marathon has also structured the notes with flexibility, allowing for conversion into cash, common stock, or a combination of both. This structure depends on the company’s financial strategy.

Furthermore, Marathon stated that the net proceeds from this offering might be used for purposes other than the Bitcoin acquisition.

“MARA intends to use the net proceeds from the sale of the notes to acquire additional Bitcoin and for general corporate purposes, which may include working capital, strategic acquisitions, expansion of existing assets, and repayment of debt and other outstanding obligations,” the firm stated.

Read more: What is Cryptocurrency Mining?

Following the announcement, Fred Thiel, Chairman and CEO of Marathon Digital, wrote on his X (Twitter) that they are “getting ready to buy more BTC” and tagged MicroStrategy’s founder, Michael Saylor, on his post. MicroStrategy is known as a public company with the largest Bitcoin holding to date, owning 226,500 BTC.

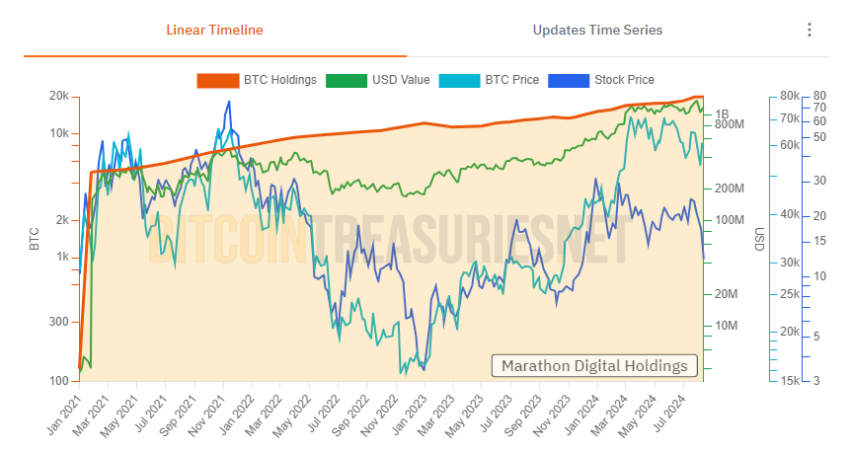

This move follows the firm’s recent $100 million Bitcoin purchase. As of July 25, Marathon’s Bitcoin balance was $20,000.

However, Marathon’s stock price performance has yet to reflect the enthusiasm for this initiative. According to Google Finance’s data, MARA’s price decreased by 3.99% in the pre-market trading hours at 09:04 ET, trading at $16.32.

Read more: Best Crypto Mining Stocks to Buy or Watch Now

Marathon Digital’s strategy is in line with the broader trend of public Bitcoin mining firms expanding their operations. For example, BeInCrypto reported that in July, Iris Energy, a Bitcoin miner based in New South Wales, raised $413 million.

The company intends to use these funds to increase its operational capacity, adding 30 EH/s and 510 megawatts (MW) of data centers, which will fully support its expansion goals by 2024. This financial move also fortifies Iris Energy’s position and provides flexibility for future procurement, additional power capacity, and strategic monetization opportunities.