Despite not yet showing any bullish reversal signs, Cronos (CRO) could be approaching the end of its long-term corrective pattern.

CRO has been falling since reaching an all-time high price of $0.97 on Nov. 2021. The downward movement has so far led to a low of $0.1 on June 15, 2022. This is a decrease of 89% measuring from the all-time high price.

SponsoredMore importantly, the downward movement also caused a breakdown from an ascending support line, which had been in place for 553 days.

The closest support area is at $0.065. The area has not been reached since Jan. 2021.

Technical indicators do not yet show any bullish reversal signs, but the weekly RSI has fallen to a new all-time low (red icon).

Oversold conditions

Similar to the weekly time frame, the daily time frame does not show any bullish reversal signs, even though the RSI is oversold.

While initially, the RSI generated bullish divergence, its trendline has now broken. This is a sign that the trend is bearish and further lows could follow.

CRO wave count analysis

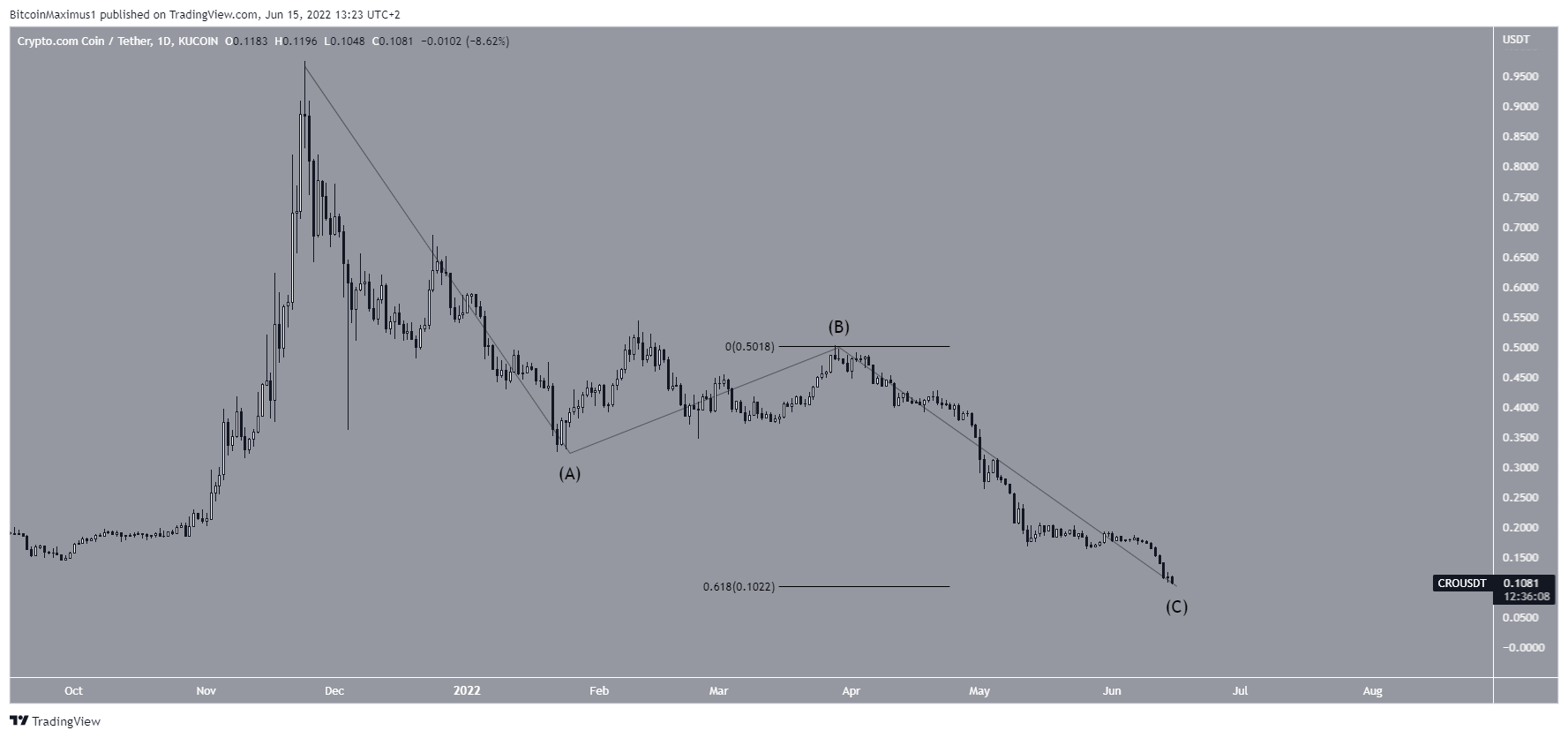

The wave count indicates that CRO has been decreasing in an A-B-C corrective structure since reaching an all-time high on Nov. 2021. If so, it is currently in the C wave.

SponsoredGiving waves A:C a 1:1 ratio would lead to a low of $0.1, very close to the current price.

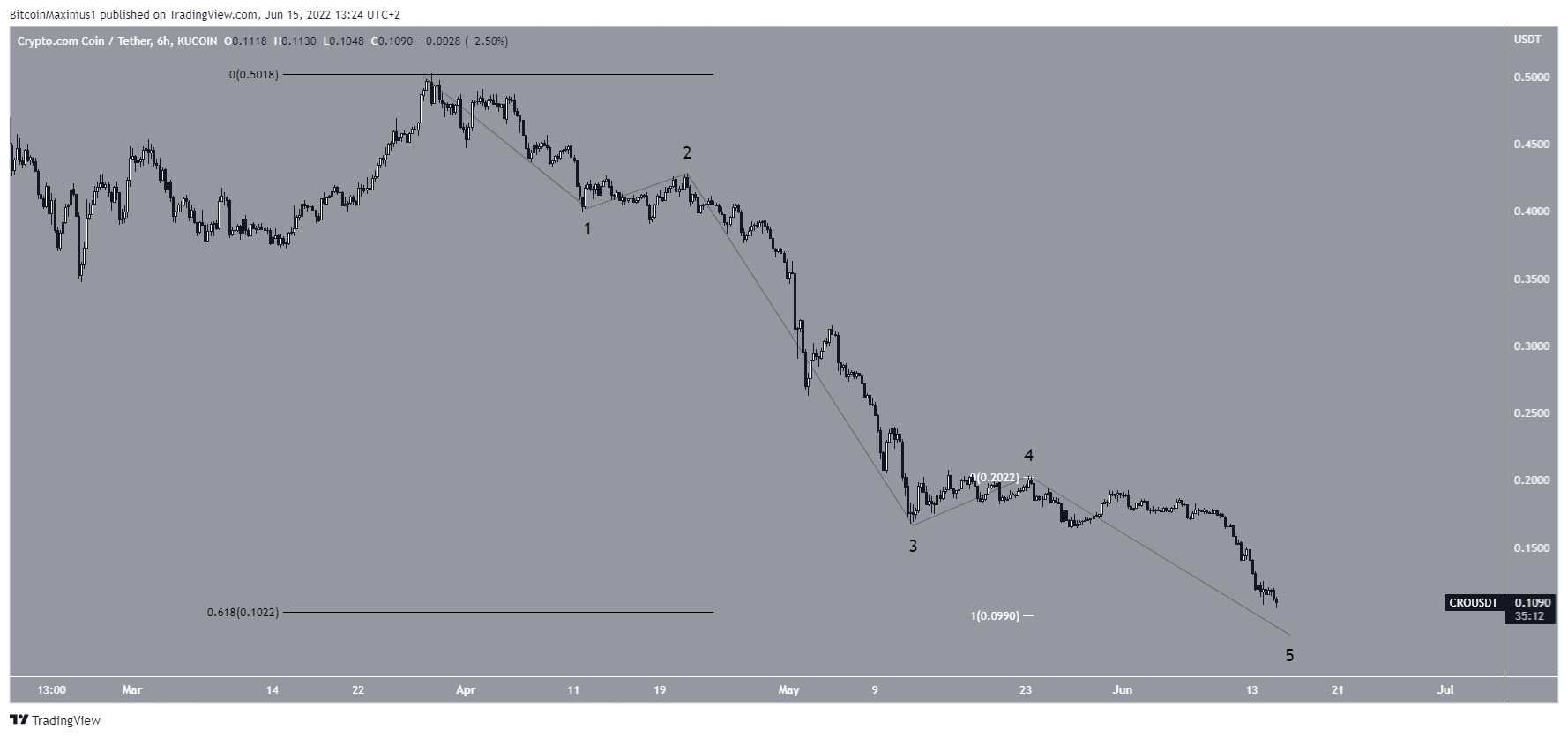

Similarly, a closer look at the sub-wave count shows that CRO is in the fifth and final sub-wave. Giving sub-waves one and five a 1:1 ratio would lead to a low of $0.099, in line with the Fib target from waves A:C.

So, the wave count and price action/indicator readings are not in alignment with each other, since the former suggests that a bottom is close while the latter does not.

For Be[in]Crypto’s latest bitcoin (BTC) analysis, click here