Cardano founder Charles Hoskinson lauded USDM, a new entrant in the stablecoin market. Reports suggest it may be more advanced than USD Coin (USDC).

The stablecoin market remains one of the most competitive sectors in the US, with political players and traditional banks competing for a share of the space.

Cardano Founder Hails New Stablecoin More Advanced Than USDC

SponsoredHoskinson praised Moneta’s USDM stablecoin, advertising it as the most advanced stablecoin ever built. His statement highlighted the project’s ambitions to eclipse legacy finance with a blockchain-native alternative.

After a workshop in Buenos Aires, the crypto executive also revealed progress on what he called the first private stablecoin. Other community members echoed his statement, further cementing USDM’s potential as a major innovation.

“While USDM is solid, what’s cooking in Buenos Aires is next level. Privacy-enabled stablecoins with granular permission controls? That’s not just disrupting TradFi, that’s replacing it entirely. The complexity jump from USDM to this is like going from checkers to 4D chess,” wrote X user T.

USDM, issued by Moneta, is being developed with a focus on privacy, permissioned visibility, and enterprise-grade functionality.

According to Andrew Westberg, W3i’s CTO, its architecture goes far beyond what traditional stablecoins like USDC can currently offer.

Westberg described real-world use cases such as complex payroll structures, where different team members require varying levels of transactional visibility based on role or legal authority.

Sponsored SponsoredBy contrast, Westberg says Circle’s USDC stablecoin is incapable of any of the above requirements, with USDM’s edge bordering everything it does being public.

This delineation places USDM in a distinct category of next-generation stablecoins aimed at replicating and potentially replacing traditional financial (TradFi) workflows using blockchain rails.

USDC Leads in Scale, Adoption, and Institutional Trust

However, some users remain skeptical, citing concerns over a product that lacks government-level integrations.

Sponsored“Love the ideas behind it, but this is why I can’t shake the feeling USDC would’ve been a better fit and less reinventing the wheel so to speak. I also see very few uses for stable coins that lack government level integrations,” one user observed.

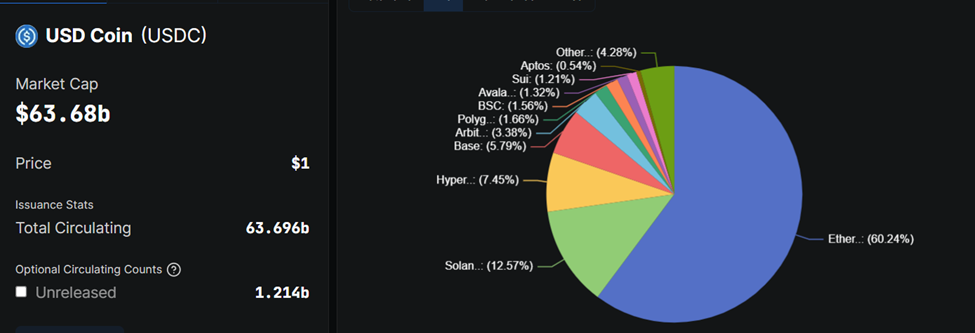

In the same way, when it comes to scale and adoption, USDC still holds a commanding lead. According to DeFiLlama data, USDC has a market cap of $63.68 billion.

Circle’s stablecoin is also issued across a broad range of networks, including Ethereum (60.24%), Solana (12.57%), Base (5.79%), and Hyperliquid (7.45%). It currently circulates over 63.7 billion tokens.

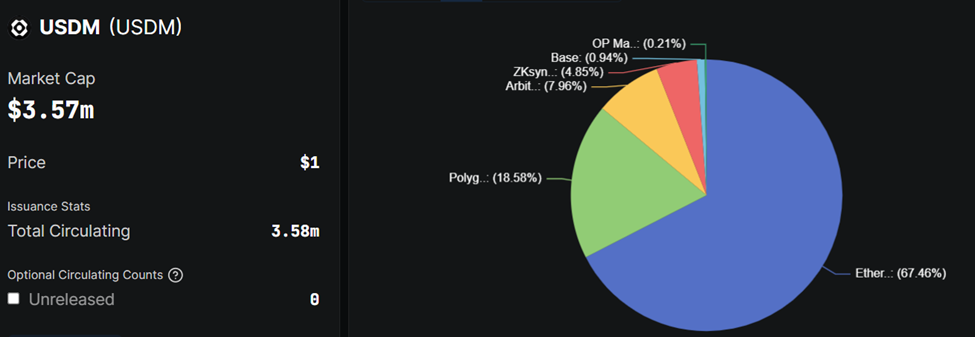

USDM, in contrast, remains in its infancy with a market cap of just $3.57 million and 3.58 million tokens in circulation.

Sponsored SponsoredIts deployment is currently concentrated on Ethereum (67.46%), Polygon (18.58%), and Arbitrum (7.96%). USDM also has a limited multichain presence compared to USDC’s broad reach.

USDC’s issuer, Circle, recently went public, adding to its institutional edge. The listing enhances Circle’s transparency, regulatory access, and credibility, which are critical factors for large institutions looking to integrate stablecoins.

Sponsored SponsoredThis public status likely gives USDC a further advantage over experimental offerings like USDM, especially regarding compliance and onboarding within TradFi.

Still, USDM’s focus on privacy and complex role-based access could carve a niche for enterprise applications and legally sensitive environments.

If it delivers on its ambitious design, it may not rival USDC in scale anytime soon, but it could set a new benchmark for what stablecoins are capable of.