BlackRock has been purchasing large quantities of Ethereum, contributing to rumors that it’s planning to launch staking on its ETF. The SEC recently ruled that “staking-as-a-service” protocols are not securities, which is further driving the speculations.

When the Commission changed this rule, it attracted fiery condemnation from current and former employees. Presently, BlackRock’s biggest obstacle might be in fighting a political battle.

SponsoredBlackRock is Selling Bitcoin for Ethereum

BlackRock currently issues the largest Ethereum ETF, and this market is doing particularly well right now. However, since the SEC updated its policy on ETF staking a few days ago, several asset managers have already submitted proposals to take advantage of it.

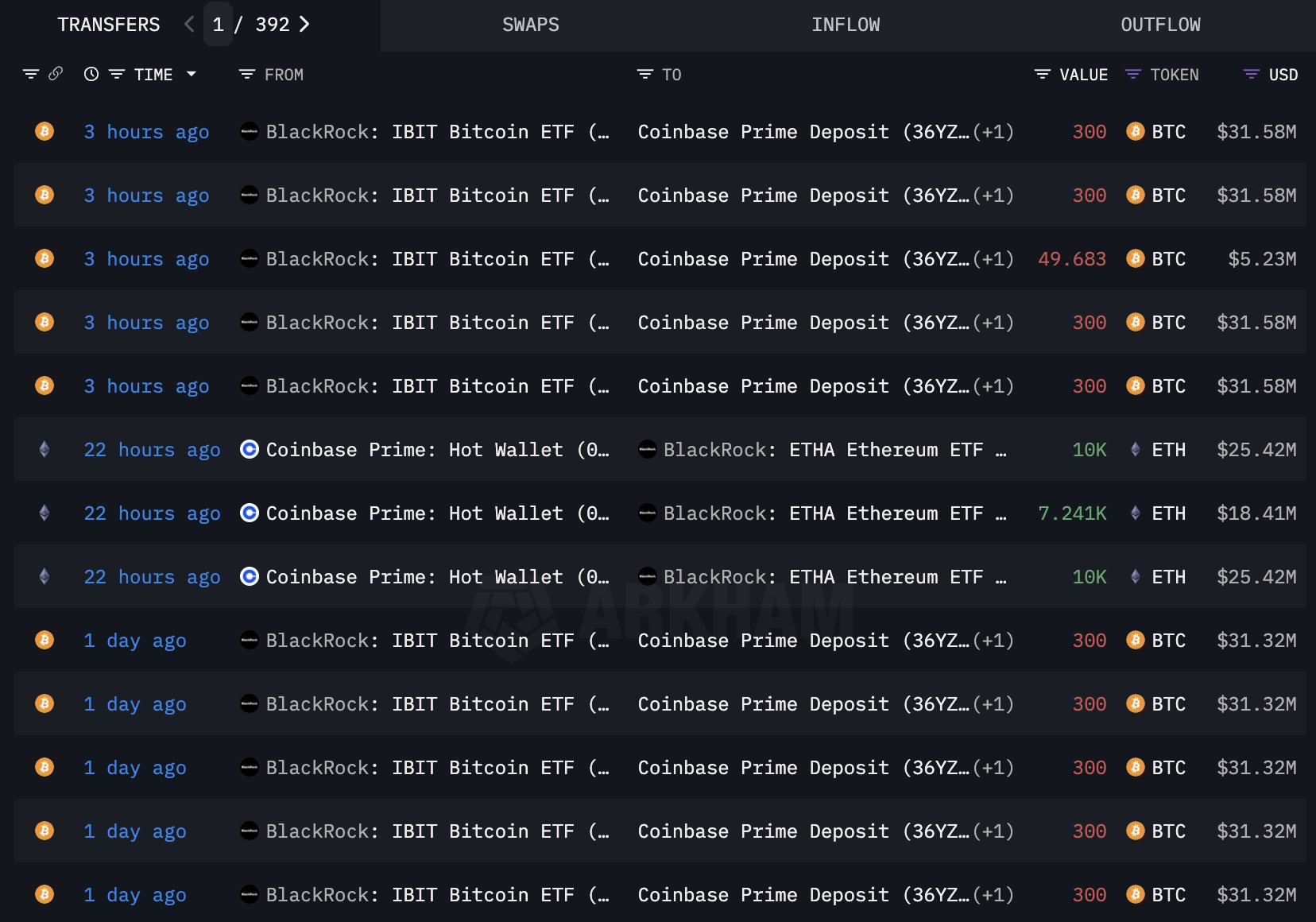

On-chain data shows that BlackRock is buying a lot of Ethereum, leading to rumors that it’s aiming for a staking ETF:

Specifically, BlackRock is selling huge quantities of Bitcoin to pay for this Ethereum. This could, in all likelihood, be due to the increasing demand for Ethereum ETFs in the US market right now.

Ethereum ETFs saw 11 consecutive days of inflows, and total net assets are approaching $10 billion. However, a few key pieces of evidence support the ETF staking rumors.

Major issuers have been persistently demanding ETF staking, and the SEC punted on a decision in April. Now that the Commission ruled that “staking-as-a-service” protocols are not securities, it could open up room for this new product.

Reportedly, BlackRock executives are lobbying the SEC to officially confirm this new rule change.

So, what’s the problem? If the SEC is amenable, and the industry greatly desires it, why couldn’t the Commission formally approve staking integration in spot ETFs?

In a word, the main hurdles seem to be political. The SEC has already drawn controversy over its recent crypto-friendly policy shifts. Its recent decision on PoS only brought worse condemnation.

SponsoredCaroline Crenshaw, an anti-crypto Commissioner, also attacked the SEC’s ETF staking decision, claiming that its crypto policy is practically defined by wishful thinking.

The entire crypto industry is receiving increased hostility and reduced support in the political sphere. If this request becomes a big fight, it may prove a costly one. Is it the highest priority right now?

Also, even though crypto staking does not fall under the current securities law, the SEC will still need to scrutinize how staking mechanics interact with custody and risk disclosures. It must be comfortable that retail investors won’t face hidden slashing or liquidity constraints.

Simply put, this hypothetical product offering is not the only lucrative opportunity that needs political support. The SEC might still approve ETF staking, but this is the biggest obstacle at the moment.

BlackRock’s internal logic is opaque; it may be preparing for a major effort or focusing on other priorities. Looking ahead, it could go either way.