On Tuesday, Bitcoin exchange-traded funds (ETFs) reversed three consecutive days of outflows to post over $350 million in net inflows.

This reversal is notable as it occurred despite BTC closing the day in the red, highlighting a shift in investor sentiment that could signal strengthening bullish conviction.

SponsoredInstitutions Load Up on Bitcoin ETFs Amid Sideways Market

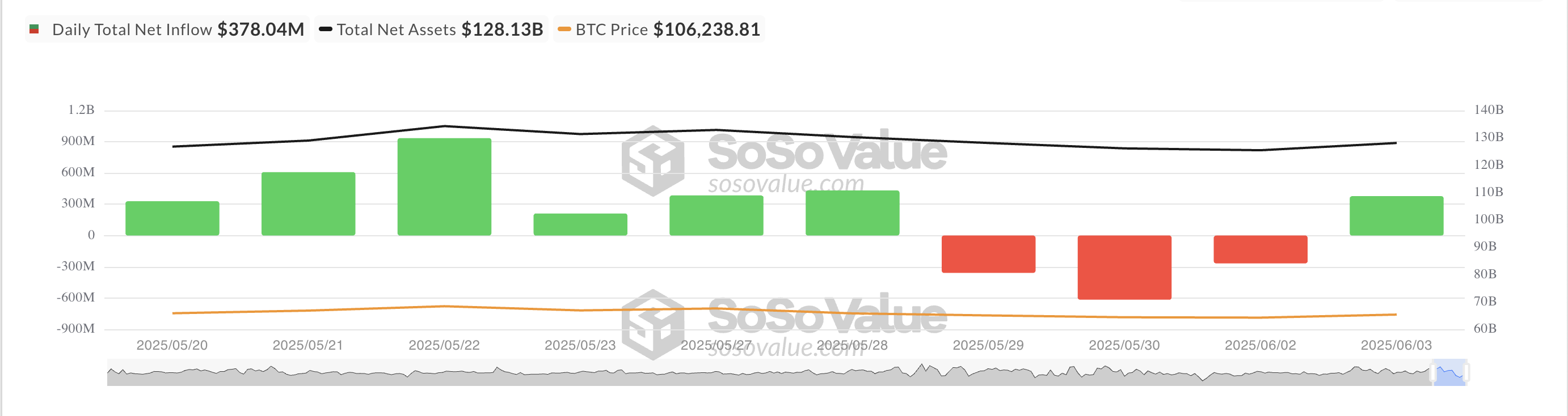

According to SosoValue, on Tuesday, investors poured $378.04 million in new capital into BTC-backed funds, pushing the total net asset value of all BTC spot ETFs to $128.13 billion.

While BTC’s spot price has struggled to gain traction, extending its recent trend of sideways movement with only marginal gains today, ETF demand appears to be decoupling from short-term price action. The inflows suggest that institutional investors may be buying the dip even as the market shows little immediate momentum.

Ark Invest and 21Shares’ ETF ARKB recorded the largest daily net inflow, totaling $140 million, bringing its total cumulative net inflows to $2.51 billion.

Fidelity’s ETF FBTC recorded the second-highest net inflow of the day, recording $137 million. The ETF’s total historical net inflows now stand at $11.69 billion.

Cautious Market Mood as Open Interest Slides

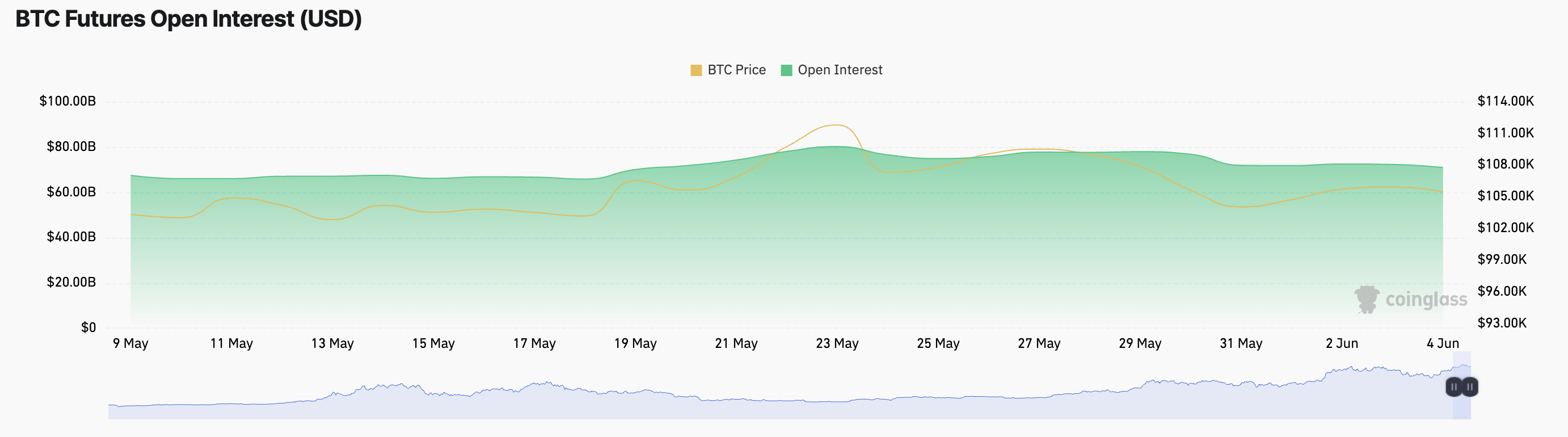

Today, open interest in BTC futures has declined, indicating that many derivatives traders are stepping back from the market. At press time, this is at $70.89 billion, plunging 3% over the past day.

Open interest measures the total number of active futures or options contracts that have not been settled or closed. When it falls while BTC’s price is stuck in a sideways trading range, traders are closing positions and stepping back from the market due to uncertainty or lack of conviction.

This decline in participation signals weakening momentum, making a BTC price breakout less likely in the near term.

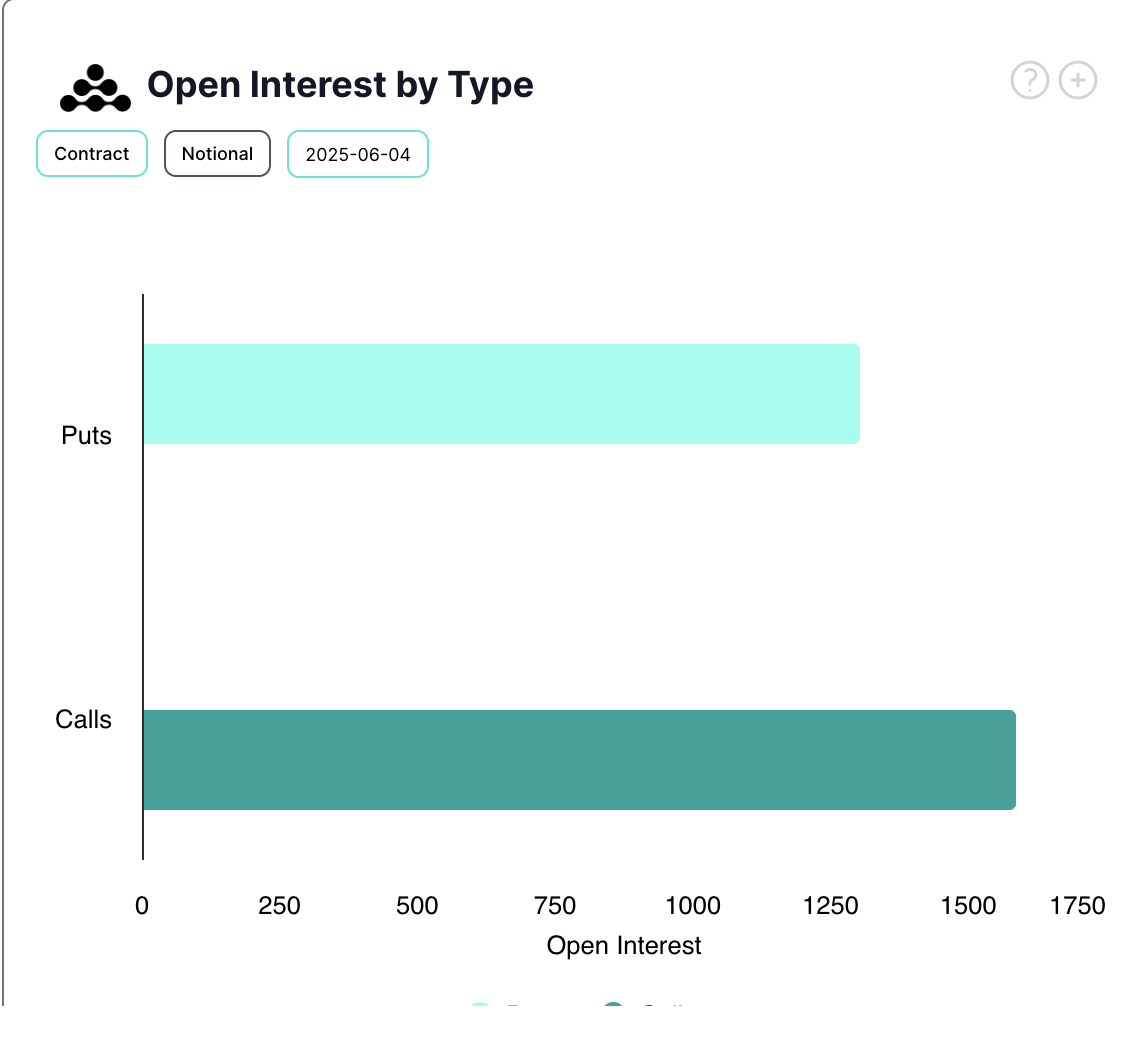

However, the demand for call options has surged today, implying that some traders are positioning for an upside move. When the demand for calls exceeds puts, it reflects growing optimism among traders and hedging against a potential breakout.

The current market trends hint at a growing undercurrent of bullish sentiment, which, if market conditions improve, could set the stage for a broader recovery.